Tax withholding payroll calculator

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

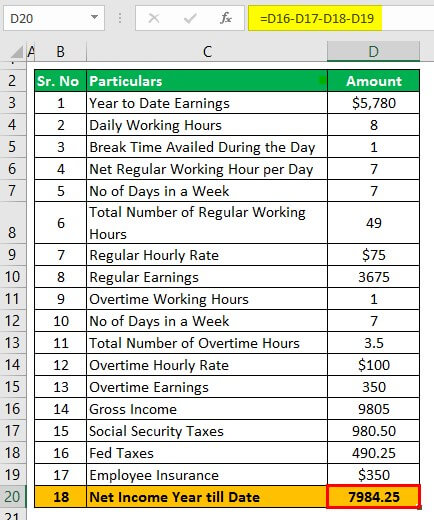

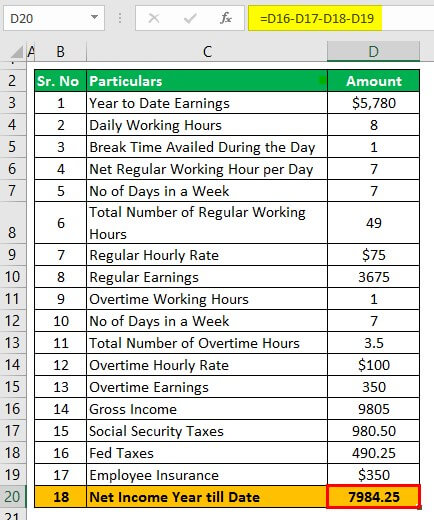

Hourly Paycheck Calculator Step By Step With Examples

Ad Looking for how to calculate payroll taxes.

. There are 3 withholding calculators you can use depending on your situation. Withholding Calculator when you have a copy of your 2017 tax return or your 2016 return available. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your.

Get 3 Months Free Payroll. 2022 Federal income tax withholding calculation. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to.

For example if an employee earns 1500 per week the individuals. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. 1400 take that refund amount and divide it by the number of months remaining this year if we are in May you would have 7 months left.

Having this will make using the Withholding Calculator easier. Ad Compare This Years Top 5 Free Payroll Software. Gather Relevant Documents First gather all the documentation you need to reference to calculate withholding tax.

Content updated daily for how to calculate payroll taxes. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Supports hourly salary income and multiple pay frequencies.

The calculator includes options for estimating Federal Social Security and Medicare Tax. Feeling good about your. Computes federal and state tax.

Ad Compare This Years Top 5 Free Payroll Software. Process Payroll Faster Easier With ADP Payroll. For example if you received a tax refund eg.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Get 3 Months Free Payroll. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Subtract 12900 for Married otherwise. It only takes a few seconds to calculate the right amount to deduct. The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The Withholding Calculator helps you. Free Unbiased Reviews Top Picks.

With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. How do I change. It will confirm the deductions you include on your.

Ad Calculate Your Payroll With ADP Payroll. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Process Payroll Faster Easier With ADP Payroll.

W-4 Withholding Calculator Updated for 2021 Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Get Started With ADP Payroll. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Free Unbiased Reviews Top Picks. Ad Calculate Your Payroll With ADP Payroll.

Here are the steps to calculate withholding tax. Get Started With ADP Payroll. Thats where our paycheck calculator comes in.

This free easy to use payroll calculator will calculate your take home pay.

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Federal Withholding Tax Youtube

Free Payroll Calculator And You Can Register To Save Paychecks Compute Employer S Taxes And Manage Payroll For Free Payroll Taxes Payroll Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Manager Expert Review Pricing Alternatives 2022 Selectsoftware Reviews

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Calculator With Pay Stubs For Excel

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Pay Tax Calculator Clearance 52 Off Www Wtashows Com

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Ca Appstore For Android

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Payroll Taxes Methods Examples More

Free Payroll Tax Paycheck Calculator Youtube

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator